Tax Payout Calendar 2026 Foremost Notable Preeminent. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Tax calendar click here to view relevant act & rule.

Due date for deposit of tax deducted/collected for the month of june, 2025. Filing of form gstr 7/8 for the month of march 2025. Avoid penalties with timely filings.

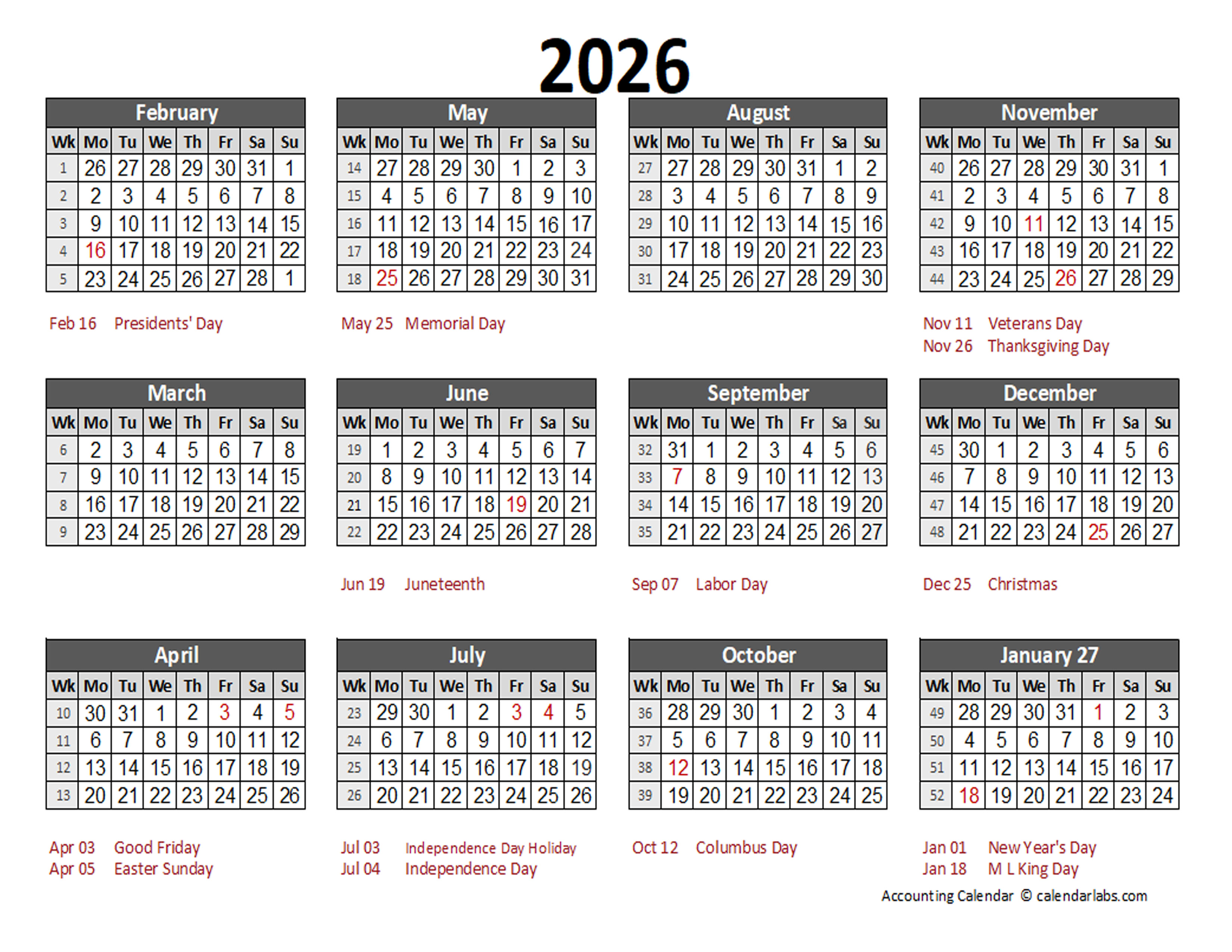

Source: www.calendarlabs.com

Source: www.calendarlabs.com

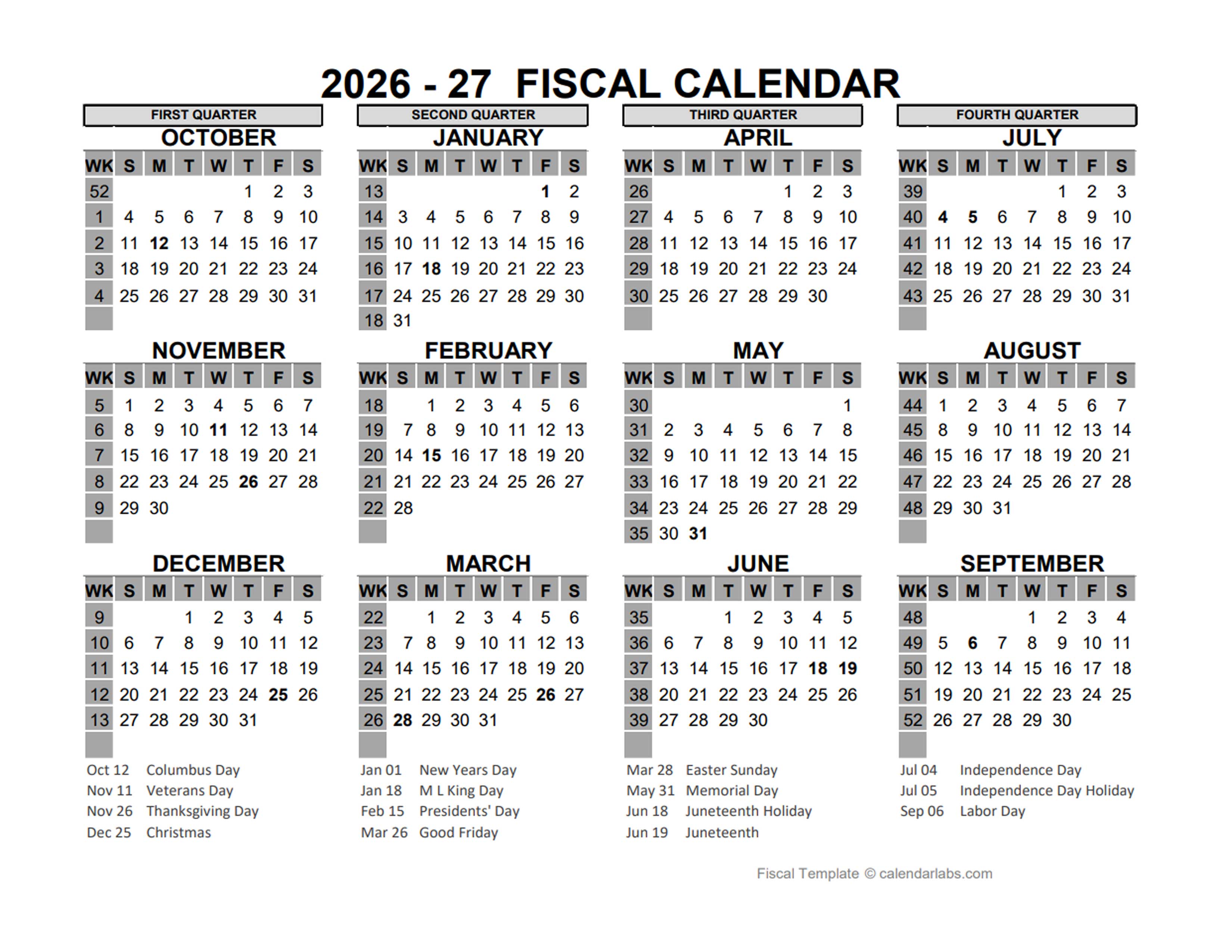

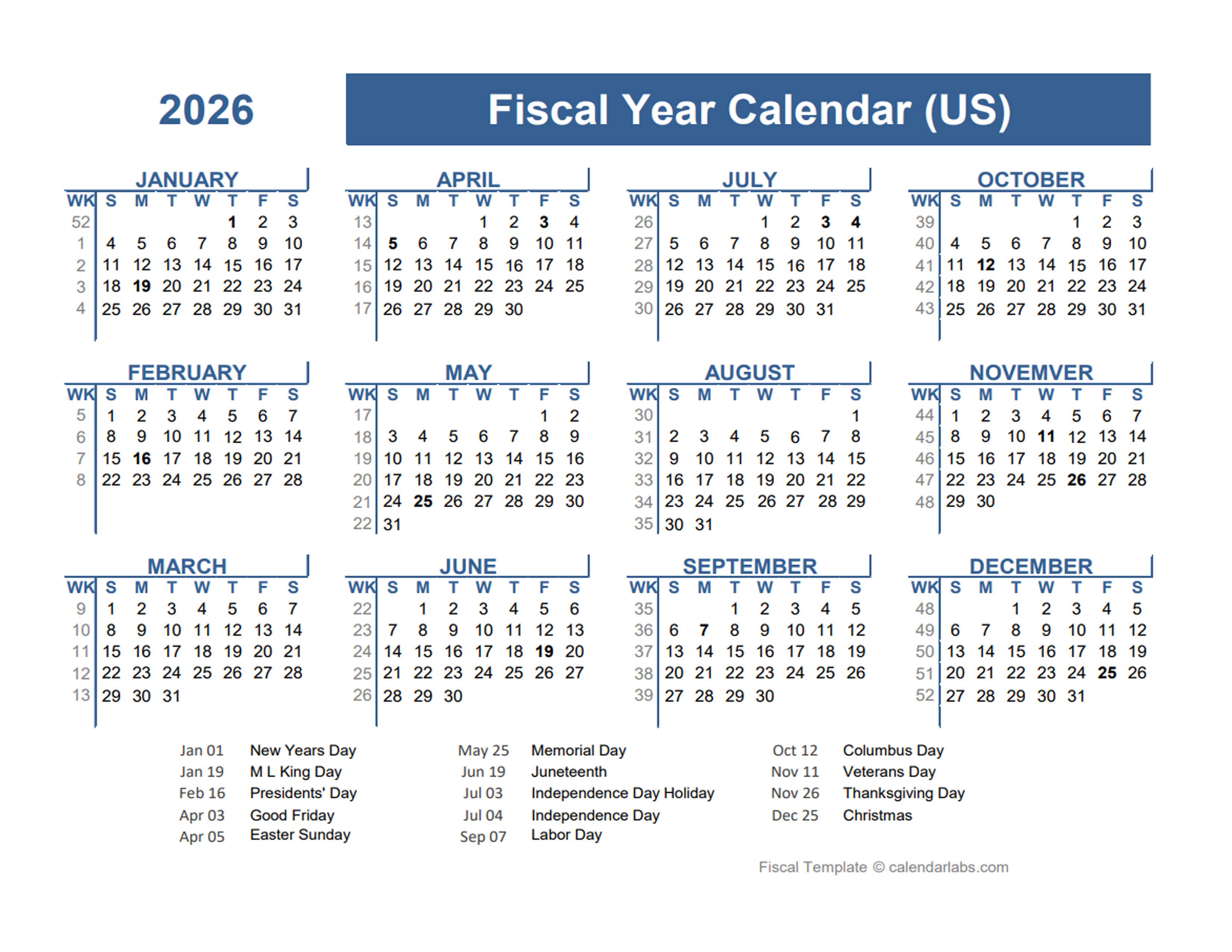

2026 US Fiscal Year Template Free Printable Templates A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Timely payment of taxes not only gets you immense benefits in terms of savings but also keeps you out of troubles like penalisation, bad.

Source: johndhylton.z13.web.core.windows.net

Source: johndhylton.z13.web.core.windows.net

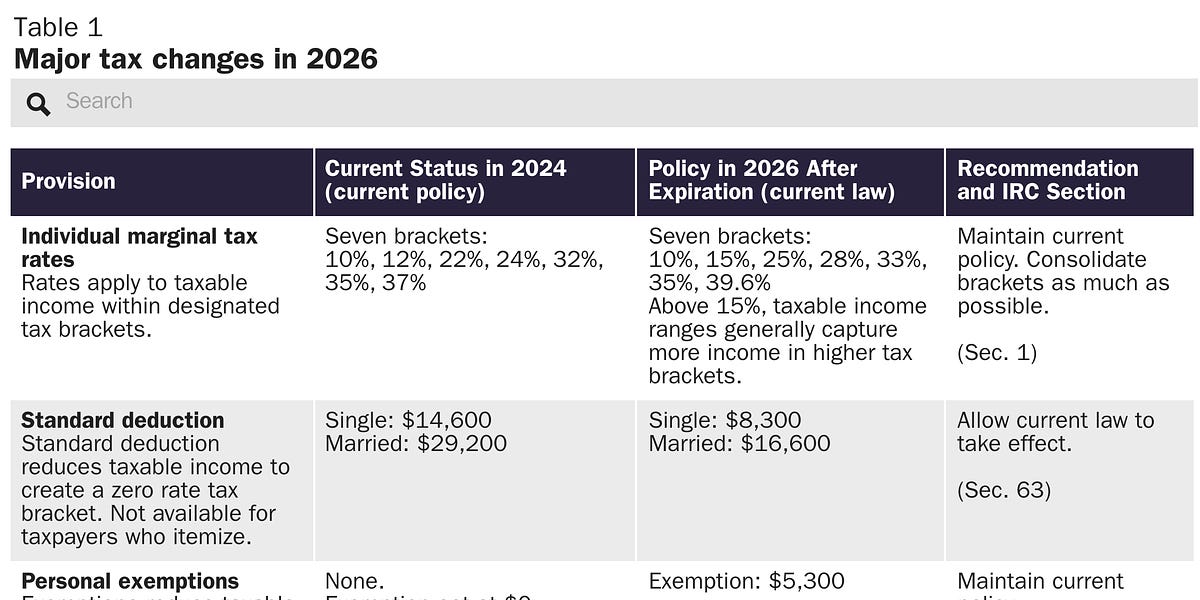

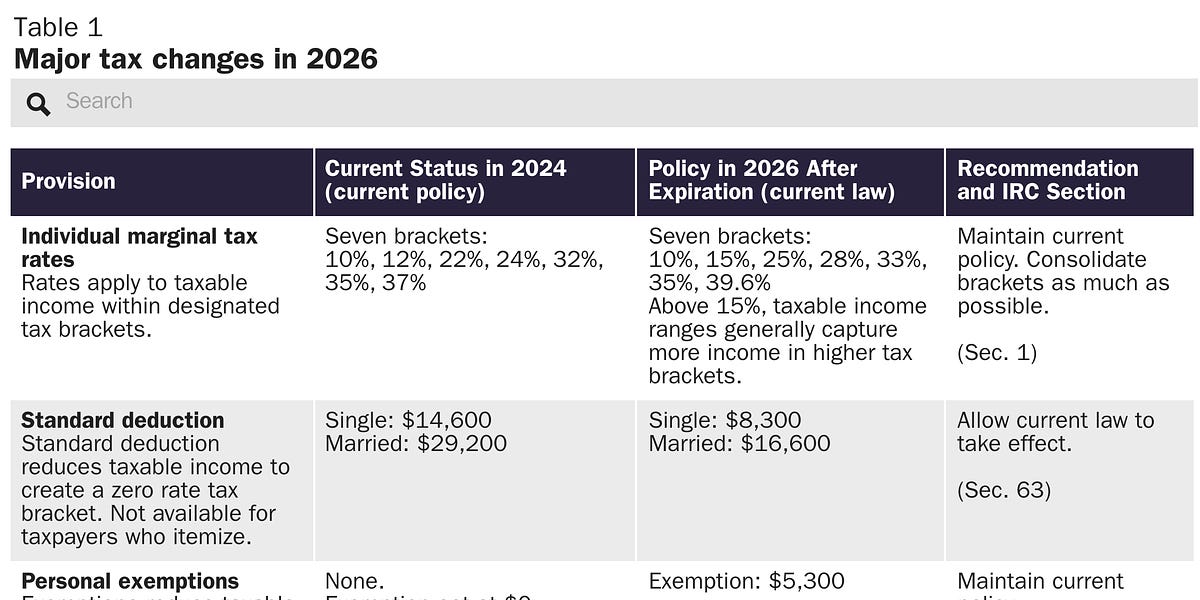

20252026 Tax Brackets A Comprehensive Overview John D. Hylton A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Filing of form gstr 7/8 for the month of march 2025.

Source: adamnmichel.substack.com

Source: adamnmichel.substack.com

2026 Tax Increases in One Chart by Adam Michel Due date for deposit of tax deducted/collected for the month of june, 2025. Tax calendar click here to view relevant act & rule.

Source: calendar.weloveprintables.net

Source: calendar.weloveprintables.net

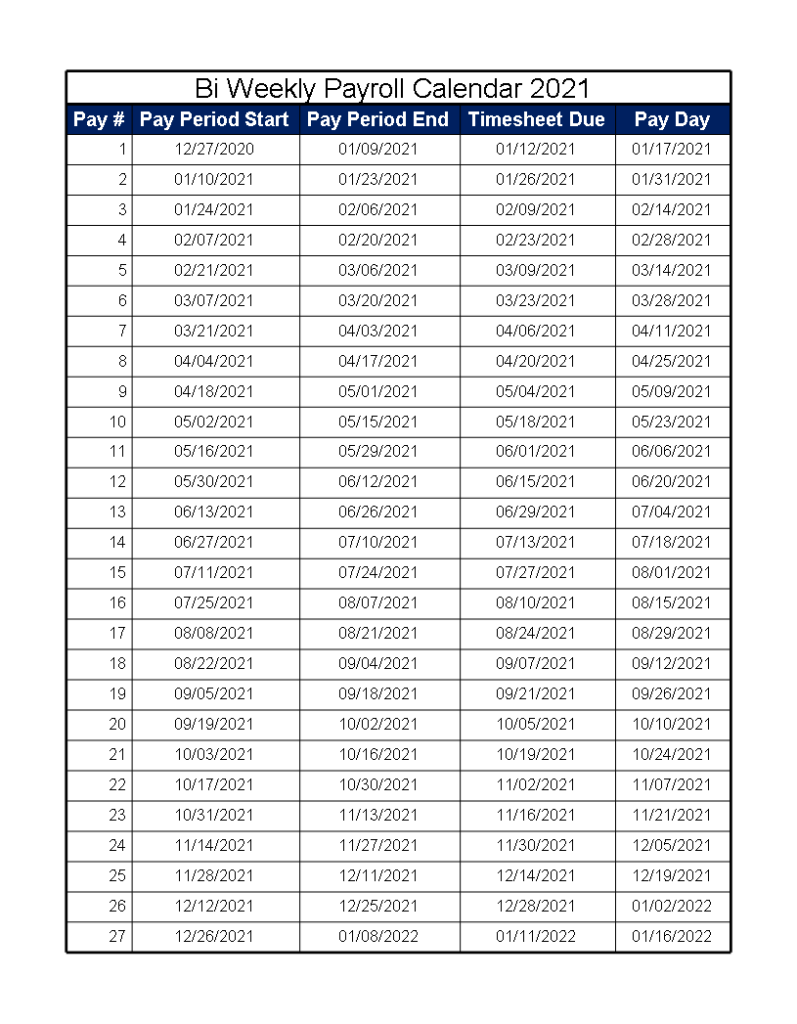

2026 Biweekly Payroll Calendar Free Printable Calendar Filing of form gstr 7/8 for the month of march 2025. Due date for deposit of tax deducted/collected for the month of june, 2025.

Source: evelynwhitaker.pages.dev

Source: evelynwhitaker.pages.dev

Understanding the 2026 Tax Bracket Changes A Comprehensive Guide A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Filing of form gstr 7/8 for the month of march 2025.

Source: braydenmullen.pages.dev

Source: braydenmullen.pages.dev

Estimated Federal Tax Brackets 2026 Brayden Mullen Info and News Avoid penalties with timely filings. Filing of form gstr 7/8 for the month of march 2025.

Source: maryzwilliams.pages.dev

Source: maryzwilliams.pages.dev

20252026 Tax Brackets A Comprehensive Overview Mary Z. Williams Avoid penalties with timely filings. Due date for deposit of tax deducted/collected for the month of june, 2025.

Source: www.calendarlabs.com

Source: www.calendarlabs.com

2026 Accounting Calendar 544 Free Printable Templates This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor. Due date for deposit of tax deducted/collected for the month of june, 2025.

Source: www.calendarlabs.com

Source: www.calendarlabs.com

20262027 Fiscal Planner USA Free Printable Templates Avoid penalties with timely filings. Timely payment of taxes not only gets you immense benefits in terms of savings but also keeps you out of troubles like penalisation, bad.

Source: nettieaadams.pages.dev

Source: nettieaadams.pages.dev

Tax Plan 2026 Lily Downing Filing of form gstr 7/8 for the month of march 2025. Due date for deposit of tax deducted/collected for the month of june, 2025.

Source: glentlopez.pages.dev

Source: glentlopez.pages.dev

Navigating The Fiscal Year 2026 Pay Period Calendar A Comprehensive Due date for deposit of tax deducted/collected for the month of june, 2025. Tax calendar click here to view relevant act & rule.

Source: glentlopez.pages.dev

Source: glentlopez.pages.dev

Navigating The Fiscal Year 2026 Pay Period Calendar A Comprehensive This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor. Filing of form gstr 7/8 for the month of march 2025.